An Examination of Hong Kong's LERS

- Discuss Diglett

- Sep 7, 2025

- 7 min read

This article is co-authored by Luo Xuhong and Adeline Li. Cover image by Stacey Ngiam.

Since its introduction in 1983, the Hong Kong’s Linked Exchange Rate System (LERS) has pegged the HKD to the USD, and later expanded into a trading band of HKD 7.75-7.85 in 2005. The currency peg has long served as the cornerstone of the city’s financial stability and its role as a global financial hub as the city weathered severe economic and political crises ranging from SARS and Covid to the 2008 financial crisis and 2019 political protests.

How does the currency peg work? Simply put, the HKMA’s dual Convertibility Undertakings (CU) form the core aspects of the HKD peg: the strong-side CU commits the HKMA to sell an unlimited sum of HKD for USD when stronger band of 7.75 is reached. Similarly, when the HKD reaches the weaker band of 7.85 per USD, the weak-side CU commits the HKMA to sell USD for HKD as well.

Managed by the HKMA’s currency board, the HKD peg is backed by reserves to the tune of twice its monetary base. In other words, the HKMA has enough of a buffer to exchange each HKD in circulation with twice its equivalent in USD.

Beyond its crucial role in underpinning the city’s standing in world financial markets, one often overlooked downside is the loss of monetary policy independence. Also commonly known as the Impossible Trinity, Hong Kong has sacrificed its central bank’s ability to adopt its own monetary policy in return for attaining the other goals of a fixed exchange rate and open capital flows.

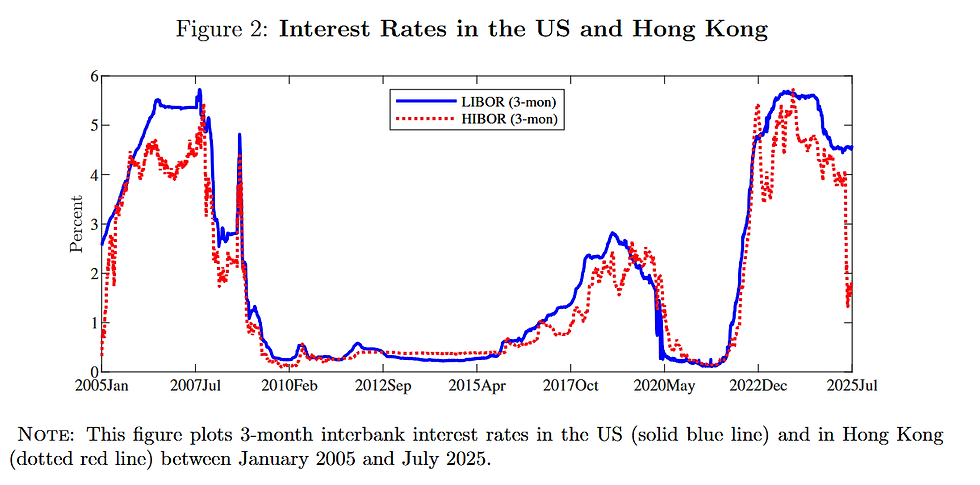

As interest rates in the city must follow Federal Reserve decisions, this has resulted in undesirable implications on the city’s economy when economic realities in the US diverge from Hong Kong, to be examined shortly below.

Despite the HKMA’s robust war chest of fiscal reserves, growing concerns have arisen over Hong Kong’s undue exposure to geopolitical turbulence after a series of developments involved the HKD whipsawing at both ends of its trading band within the brief span of 2 months.

Back in Apr-May 2025, shockwaves unleashed by US tariff measures sent multiple Asian currencies appreciating vis-à-vis the USD as investors swiftly unwinded long positions on the greenback. Around the same time, market anticipation of upcoming IPOs for several large Chinese firms (CATL, Jiangsu Hengrui, Foshan Haitian) led to an inflow of capital entering Hong Kong. This confluence of events translated into a surge of HKD demand, sending it rising sharply to the stronger end of the band (7.75).

In response, the HKMA waded into the FX market, spending a record HK$60.5 billion and HK$56.1 billion across 2 days to defend the peg and keep HKD appreciation within its band. Impacts of the unprecedented spike in liquidity were immediate. Interbank borrowing rates crashed while the HKD traded at the weaker end of the band within days, forcing the HKMA to intervene once again.

This time round, the HKMA faces a prolonged battle ahead. Selling the USD would drain the excess liquidity and force the HKD to appreciate once more, but the resultant jump in interest rates would deal a crushing blow to nascent recovery efforts by the city's beleaguered real estate sector. Instead, the HKMA has opted to intervene in more gradual steps to reach a Goldilocks zone that allows the frail economy to recover while preserving the trading band.

Even after 4 (smaller) purchases of HKD between June and July this year, depreciation pressure on the HKD has persisted through mid-August due to effects of the carry trade (otherwise known as interest rate arbitrage) - a situation in which the interest rate differential creates a valuable opportunity for market players to borrow HKD at lower interest rates and invest in higher-yielding greenback assets.

Moreover, local banks do not necessarily follow the HKMA’s own interest rate actions closely, thereby giving traders an extended arbitrage opportunity. However, persistent capital outflows that reduce the aggregate balance will eventually force HK banks to raise their own interest rates in adherence to the US rate trend, in turn reducing the profitability of carry trades and eventually returning the HKD to the 7.8 rate.

A common refrain by speculators echoes the concern that in these times of sustained weakness, repeated interventions to defend the peg would eventually drain forex reserves to the extent that the peg would be rendered indefensible when the reserves run out one day. In reality, such an extreme scenario is unlikely to materialise anytime soon.

Apart from the HKMA’s well-endowed financial reserves, there is strong political willpower for the peg to remain intact. In fact, PBOC (China’s central bank) governor Pan Gongsheng explicitly pledged state backing earlier this year through an increase in the allocation of Chinese own foreign reserves in Hong Kong-based assets.

The emergence of unprecedented tensions between China and the US has placed Hong Kong squarely in the crosshairs between two of its largest trading partners. While the 42 year old peg has historically provided stability and confidence, growing economic and geopolitical uncertainties have renewed scrutiny over the undesirable implications of passively following US monetary policy. Next, let’s examine some popular alternatives to the peg that have been raised over the years.

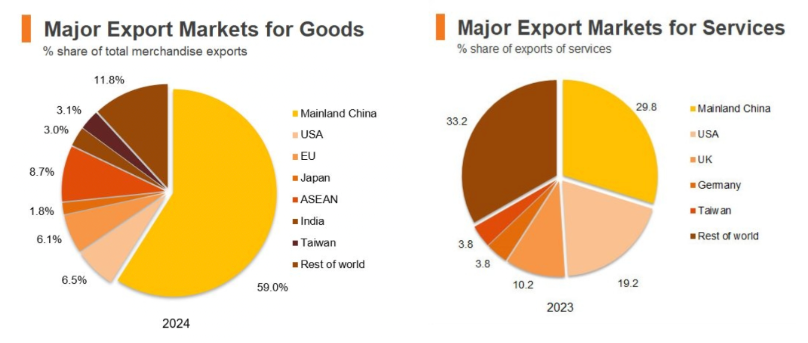

Chief among these is the re-pegging of the HKD to the Chinese Yuan. In the past decade, Hong Kong's economy has deepened its integration with that of mainland China. More than 50% of Hong Kong's total trade volume last year was with the mainland. Meanwhile, the city’s economic recovery is also buoyed by a record US$104bn of Chinese funds entering the city's equity markets as of July 2025, surpassing the full-year volume recorded in 2024.

Switching to the yuan would also bring respite for the property market. After all, China's interest rates are much lower than the US' and are expected to stay low owing to low domestic inflation (in comparison, the HIBOR has rebounded to just south of 3% as of September 2025 and is expected to eventually match US overnight rates).

However, we posit that a yuan peg is unlikely to materialise in the short term. The yuan remains a partially convertible currency subject to discretionary capital controls imposed by the Chinese central bank, PBOC. Despite having made inroads in recent years (such as its Oct 2016 inclusion into the IMF Special Drawing Rights basket), the yuan remains a significant distance away from broad acceptance worldwide as a global reserve asset.

Furthermore, aligning the HKD with the yuan's own managed float currency regime would bring an end to the famed transparency of the financial hub and in turn swiftly erode investor confidence. In spite of the increasing integration of Hong Kong's economy with that of mainland China, the former remains an important conduit for mainland firms to raise foreign capital through IPOs outside tightly-controlled mainland financial markets.

Another proposal floated over the years is the pegging of the HKD to a weighted basket of major trading partner’s currencies, potentially offering greater flexibility for Hong Kong’s diversified trade patterns. Indeed, some argue that this system provides stability. As Carlos Casanova, senior Asia economist at UBP in Hong Kong, notes, “while reducing the pro-cyclical headwinds associated with the peg to the US dollar, as the business cycle becomes increasingly correlated with that of mainland China”. This model has been successfully adopted by countries with a wide range of trading partners, notably including rival financial hub Singapore.

However, transitioning into such a system will introduce significant challenges with reduced transparency in intervention mechanisms and operational complexities. Furthermore, Hong Kong’s deep ties to US-dominated trade and stocks raises doubts about whether the benefits outweigh the risks of abandoning the USD peg’s clarity. The current HKD-USD peg continues to anchor market stability and reinforces Hong Kong’s position as a financial hub; whereas a weighted basket peg, despite its theoretical advantages, may introduce uncertainties in operational processes and erode investor confidence.

For all the discussion on possible replacements for the HKD-USD peg, the endgame for the Hong Kong dollar is in plain sight. The peg will lose its meaning on the day the yuan attains its status as the (main) global reserve currency. Until then, the HKD peg remains irrefutably the best option, as it has for the last 42 years, as an anchor of financial stability that preserves the city’s status as an international financial centre.

References

Cotto, B., Nephew, E., Kwende, G., & Kejji, L. (2025). IMF Data Brief: Currency Composition of Official Foreign Exchange Reserves. International Monetary Fund. https://data.imf.org/en/news/4225global

Hale, T., Sandlund, W., & Ko, H. (2025, July 25). Chinese investment into Hong Kong surges to record high. Financial Times. https://www.ft.com/content/2ad21126-5ee0-4b06-8499-67e93d2938b9

Jermann, U. J., Wei, B., & Yue, V. Z. (2025). How Credible is Hong Kong’s Currency Peg? The Wharton School Research Paper. https://doi.org/10.2139/ssrn.5135426

Monetary Authority of Singapore. (2023, April 20). Singapore’s Exchange Rate-Based Monetary Policy. https://www.mas.gov.sg/-/media/MAS/Monetary-Policy-and-Economics/Monetary-Policy/MP-Framework/Singapores-Exchange-Ratebased-Monetary-Policy.pdf

Ouyang, I. (2025, June 18). Hong Kong Dollar’s Swings Fuel Talk on How FX Peg May Shift. Bloomberg. https://www.bloomberg.com/news/articles/2025-06-18/hong-kong-dollar-s-volatility-fuels-talk-on-how-fx-peg-may-shift

Suzuki, W., & Ye, P. (2025, May 20). CATL ups amount raised to $5.3bn Hong Kong debut on world’s top offering this year. Nikkei Asia. https://asia.nikkei.com/business/markets/equities/catl-ups-amount-raised-to-5.3bn-hong-kong-debut-on-world-s-top-offering-this-year

Trading Economics. (2025). China Inflation Rate. https://tradingeconomics.com/china/inflation-cpi

Yeung, C. (2025, August 29). Economic and Trade Information: Hong Kong. HKTDC Research. https://research.hktdc.com/en/article/MzIwNjkzNTY5

Yip, F. (2025a, June 25). HIBOR volatility: why Hong Kong’s interbank rates have plunged to near zero. IG. https://www.ig.com/en/news-and-trade-ideas/HIBOR-plunged-to-zero-250625

Yip, F. (2025b, August 19). Will Hong Kong’s interbank rates stay elevated after the recent spike? IG. https://www.ig.com/en/news-and-trade-ideas/HIBOR-surges-in-August-250819

Yiu, E. (2025, August 24). Hong Kong’s dollar-peg defence is bitter for borrowers as higher Hibor ups mortgage costs. South China Morning Post. https://www.scmp.com/business/banking-finance/article/3322822/hong-kongs-low-rate-honeymoon-ends-hkmas-dollar-peg-defence-raises-hibor

Comments