Dancing with Debt - French Public Finances

- Discuss Diglett

- Mar 6, 2025

- 8 min read

This article is co-authored by Luo Xuhong and Adeline Li. Cover image by authors.

A month ago, French prime minister François Bayrou successfully forced the France budget through a fragmented parliament, ending months of political and economic turmoil for the Fifth Republic. After surviving 6 no-confidence votes in a mere span of 3 months since taking office last December, it is clear that Bayrou’s position in office is far from secure. After all, his predecessor Michel Barnier was ousted after a failed attempt at passing his own version of the budget using article 49.3 - a special constitutional mechanism that bypasses the requirement for a parliament vote. Treading an increasingly thin tightrope as he maneuvers between the demands of the left-leaning Socialist Party and far-right National Rally, Bayrou is keen on ensuring that the minority government he leads does not face the same fate as Barnier (who served a mere 99 days in office, earning the dubious honour of France’s shortest-lived prime minister).

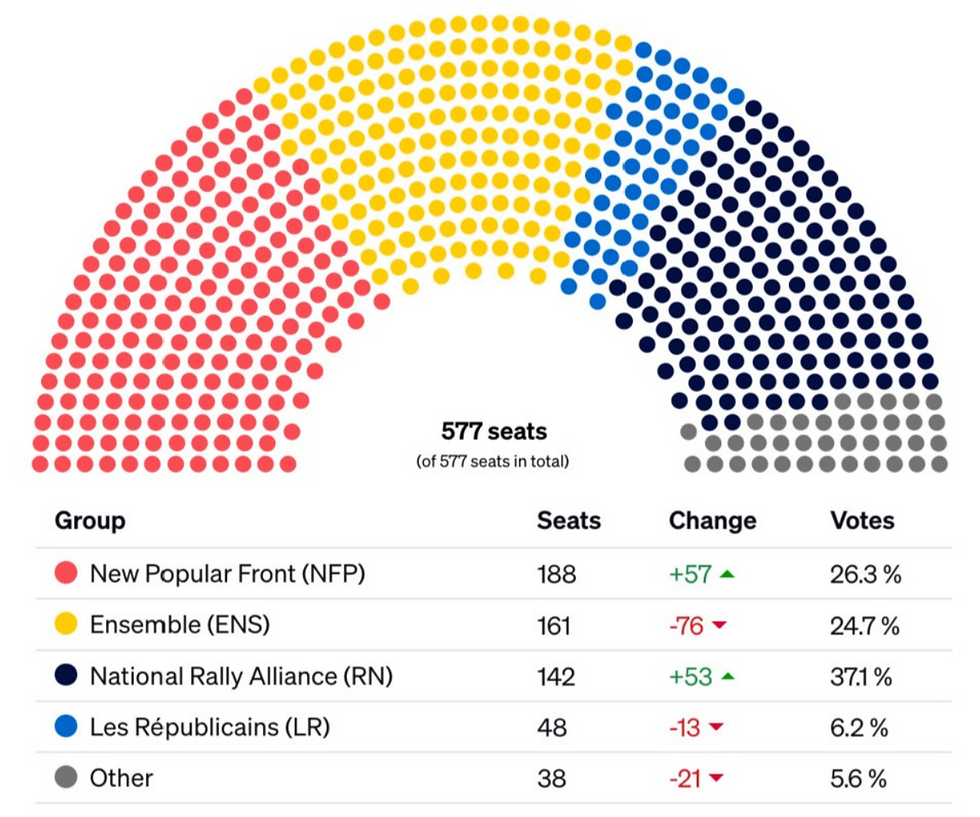

The story goes back to Macron’s failed gamble on holding snap elections in June/July 2024. Far from delivering a clear mandate for his Renaissance (RE) party, the elections resulted in a hung parliament as no party was able to win a majority of seats.

Eventually, Macron appointed Barnier and tasked his government with passing the 2025 budget. Under pressure from the European Commission to keep a growing debt pile from spiralling out of control, Barnier settled on an austerity budget that involved €40bn in spending cuts and €20bn in tax hikes. These included cuts to healthcare coverage, a reduction in the number of civil servants and teachers and a six-month freeze on pension increases. Such extreme measures did not sit well with Marine Le Pen’s RN, who teamed up with left-wing members to vote Bayrou out and in turn triggering a fresh political crisis.

Enter François Bayrou in December 2024. Known as a close ally of Macron, Bayrou brings to table more than 4 decades of political experience. Outlining a less ambitious €53 billion plan with €32 billion in spending cuts and €21 billion in tax increases, Bayrou’s budget was recently approved by the EU. The primary goal is to bring down France’s public deficit from an estimated 6% of GDP in 2024 to 5.4% in 2025. However, this figure remains above the EU’s 3% deficit cap, meaning France could still face pressure from the European Commission to implement more forceful spending cuts in subsequent years. The target also reflects a more gradual approach to fiscal consolidation compared to the 5.0% target set by the previous government. The budget is based on an optimistic growth forecast of 0.9% for 2025, but whether this estimate holds remains to be seen.

To raise revenue, the government is introducing several tax measures. Large corporations with annual revenues exceeding €1 billion will have to pay an extra levy on top of the existing 25% corporate tax rate. While this will generate additional government revenue, it could also discourage investment and make France a less attractive destination for businesses. High-income earners with incomes over €250,000 per year will be required to pay a "temporary tax," a move aimed at addressing income inequality and boosting public finances. However, there are concerns that it may lead to increased tax evasion and avoidance.

On the spending side, local governments will see major funding cuts, though a widely criticized €3 billion "reserve fund" was eventually scrapped. Other areas experiencing reductions include cultural programs, foreign aid, public broadcasting, and research / higher education. Healthcare coverage for undocumented migrants will also be reduced. Overall, government spending is aimed to shrink by 2%, marking the first time in 25 years that France has cut its budget in absolute terms. While this might help tackle the deficit, there are concerns that reducing public spending could further slow an already tepid economic growth.

Pension Reform

Next, let us examine French pension reforms, a thorny issue at the centre of the growing public deficit. Arguably the most controversial move by the Macron administration thus far, his reforms have been fiercely resisted across wide swathes of French society. Perceived as disconnected from the masses, Macron's success in forcing through the reforms in 2023 torched an unprecedented wave of protests across France as many questioned his administration's legitimacy amidst a cost-of-living crisis. While calm was eventually restored, the deeply unpopular move also came at a significant cost to his political capital. A year on, voters expressed their infuriation and handed a record number of seats to Le Pen's RN in the 2024 elections. Why are pension reforms such a polarising issue in French politics?

Traditionally, France is known for its generous pension plans that allow workers to retire at 62, the lowest retirement age across the EU. French pension payments as a percentage of retirees’ previous earnings (~75%) also significantly outrank that of other countries such as Britain (58%) and Germany (~53%). However, such largesse comes at a high cost to the French economy - around 14% of the French GDP is spent on funding its pension system, one of the highest figures across the OECD.

In essence, the reforms increase the retirement age progressively to 64 by 2032 from the current age of 62. In addition, all retirees must work for a minimum 43 years (and make the required social security contributions) before they become eligible. Special pension schemes for certain workers such as those in the energy sector, central bank and Paris metro that offer more advantageous benefits (including early retirement offers) will be gradually eliminated in favour of the general private-sector pension plan. These measures are expected to save up to €15bn in 2030.

Given the precarious nature of Bayrou’s government, it comes at no surprise that he has expressed his willingness to reopen negotiations with the centre-left Socialist Party and even promised to offer trade unions and employer federations a period of 3 months to discuss potential changes to Macron’s reforms in his first speech on Jan 14. Bayrou’s overtures to the left are seen as merely an attempt to secure the stability of his minority government over the next few months rather than any genuine attempt at offering concessions or even a partial roll-back of pension reforms. After all, Bayrou likened French public debt to “the sword of Damocles” in the same speech. Moreover, any reversal is even more unlikely in light of a February 2025 report by the French public audit office warning of a potential doubling in the pension deficit between 2035 and 2045.

Uncertainty Ahead

The French economy is facing growing challenges, with political uncertainty, a weakening job market, and declining business confidence all adding to the pressure. Economic growth managed to stay just above 1% in 2023 and 2024, but it's expected to dip below that in the next couple of years. Business sentiment has been below its long-term average (100) since October 2023. However, the decline became more pronounced from mid-2024, with sentiment dropping to 96 by November. This is also linked to the fear of a rise in unemployment and job insecurity. Between September and November 2024, public sentiment on job security worsened significantly, with the balance of opinion on unemployment jumping from +28 to +42.

One of the biggest warning signs is the downturn in the manufacturing sector. Demand has been weak, not just in France but across the eurozone, especially in Germany. For the first time since 2017 (excluding the Covid-19 period), the sector recorded job losses, with 1,700 positions cut in the third quarter of 2024. The slowdown is also hitting market services, which have been a major driver of employment. Over the past year, only 4,500 new jobs were created per quarter, a significant drop from the 36,000 per quarter seen in the previous year. With hiring slowing down, private sector employment is expected to shrink by nearly 100,000 jobs in 2025. Because of this, unemployment, which had been fairly steady going from 7.1% in early 2023 to 7.4% by late 2024, is now expected to rise even more. By the end of 2025, it could reach 8.5%, adding to concerns about job security and economic stability.

Amidst the dual issues of soaring public debt and lingering political stability, France faces another shock on the horizon: a credit rating downgrade. Capping a year of political unrest, major ratings agency Moody’s downgraded France’s long-term issuer rating from Aa2 to Aa3 in December 2024, citing the nation’s weak public finances as well as “political fragmentation [that] is more likely to impede meaningful fiscal consolidation”. The decision has led to increased pressure on France 10-year government bonds, with yields surpassing 3.05% the following week (17 December) and remaining above 3% till date. Meanwhile, fellow ratings agency Fitch has also revised France’s outlook to Negative from Stable in October. Predicting “wider fiscal deficits”, a Fitch statement warned of government debt climbing to a high of 118.5% of GDP by 2028. As borrowing costs soar to the highest point since 2012, the French government is expected to face further pressure in the upcoming months when borrowing funds to service its public debt.

Conclusion

Overall, France’s economy is facing some notable challenges. Political uncertainty, a weaker job market, and falling business confidence are all adding pressure. Growth was just over 1% in 2023 and 2024, but it’s expected to slow even more in the next two years. Unemployment is rising, and both businesses and households are feeling less secure about the future. On top of that, concerns about government debt have grown, especially with political divisions making it harder to pass long-term financial policies. Painful as it may be, further adjustments to the pension system will be needed to prevent its collapse. Credit rating agencies have taken notice, leading to downgrades that could shake investor confidence. However, while these risks are significant, France retains strong economic fundamentals. It remains a major player in the eurozone, with a strong industrial base and room for policy adjustments. If the political situation stabilizes and the government manages public finances carefully, confidence could improve, and growth could pick up again. We remain cautiously optimistic, acknowledging the risks but also recognising France's potential to recover and move forward.

References

Audureau, W., Dassonville, A., Derœux, I., Ferrer, M., Maad, A., Romain, M., & Vaudano, M. (2025, February 7). What’s in the French State’s 2025 budget. https://www.lemonde.fr/en/les-decodeurs/article/2025/02/07/what-s-in-the-french-state-s-2025-budget_6737882_8.html

Bienvenu, O. (2023, February). Macron’s French pension reform: Overview and reaction. https://www.dodspoliticalintelligence.com/wp-content/uploads/2024/07/Macrons-French-pension-reform-Overview-and-reaction.pdf

BNP Paribas Economic Research. (2024a, December 18). France: Growth eroded by uncertainty. https://economic-research.bnpparibas.com/html/en-US/France-Growth-eroded-uncertainty-12/18/2024,51168

Faggionato, G. (2025, January 17). France’s Bayrou gets spending plan approved by EU. Politico. https://www.politico.eu/article/frances-bayrou-gets-spending-plan-approved-by-eu/

Fella, S. (2025, January 20). France: recent political developments and the 2024 National Assembly elections. https://researchbriefings.files.parliament.uk/documents/CBP-10112/CBP-10112.pdf

France 24. (2025, February 20). French pension deficit set to more than double in a decade – despite reform. https://www.france24.com/en/europe/20250220-french-pension-deficit-set-to-more-than-double-in-a-decade-%E2%80%93-despite-reform

French growth: Is the worst over?. BNP Paribas Economic Research. (2025, February 20). https://economic-research.bnpparibas.com/html/en-US/French-growth-worst-over-2/20/2025,51336

Kirchner, A. (2022, October 3). Zooming in on French industrial policy. Institut Montaigne. https://www.institutmontaigne.org/en/expressions/zooming-french-industrial-policy

Locatelli, C. (2024, December 5). Chaos in the numbers – The strange case of France’s budget deficit. LSE European Politics and Policy. https://blogs.lse.ac.uk/europpblog/2024/12/05/chaos-in-the-numbers-the-strange-case-of-frances-budget-deficit/

Main measures and targets in French 2025 budget. Reuters. (2025, February 3). https://www.reuters.com/world/europe/main-measures-targets-french-2025-budget-2025-02-03/

Moody’s Ratings. (2024b, December 14). Moody’s Ratings downgrades France’s ratings to Aa3; changes outlook to stable. https://ratings.moodys.com/ratings-news/434553?gsid=76720a0e-1d8d-4ec4-a6ed-02bdc33cc82c

OECD Publishing, Paris. (2023). Pensions at a glance 2023. https://www.oecd.org/content/dam/oecd/en/publications/reports/2023/12/pensions-at-a-glance-2023_4757bf20/678055dd-en.pdf

Thomas, L. (2023, April 20). Macron pension reform ends cherished French exception . Reuters. https://www.reuters.com/world/europe/macron-pension-reform-ends-cherished-french-exception-2023-04-18/

Comments